ltccloudmining.net

Payroll process is not only the calculation of employee's basic remuneration but also any overtime payments, special payments or bonuses given to the employee in the period in question. Moreover remuneration is calculated keeping in mind hourly employees, salaried employees, new hires and terminations. Calculation of gross salaries and deductible a...

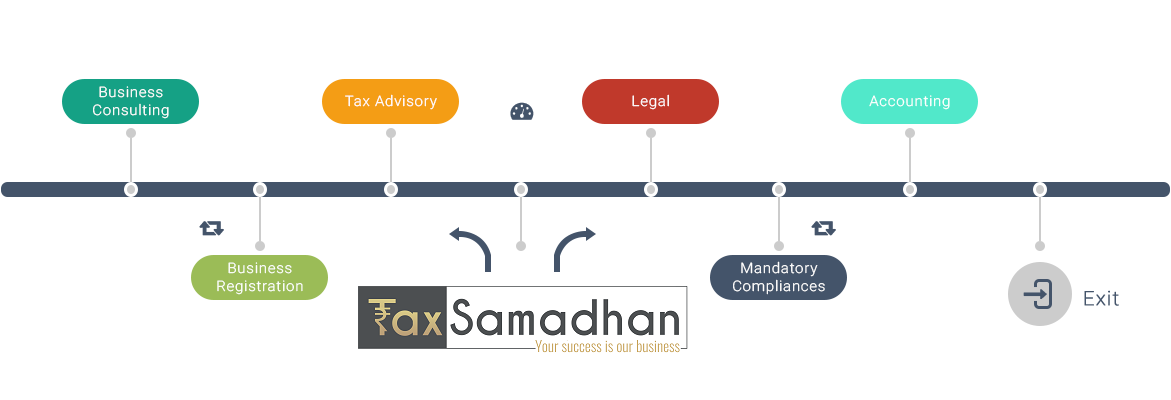

Questions in Mind 1) How can TAXSAMADHAN help me in securing Funding? The key to a successful funding is a successful business pitch supported by a business valuation and a strong internal control system to pass the Due Diligence Check of the Investors. TAXSAMADHAN has been assisting start-ups and SMEs in securing funding for their busine...

Extensive experience in providing assurance services under various statutes across various industries for the past several decades. IND-AS, IFRS & US GAAP ADVISORY · Advising and assisting clients in respect of accounting under various GAAPs which involves assistance in implementati...

Questions in Mind1) What is a Trademark? Trademark is a symbol, word, phrase, logo, or combination of these that legally distinguishes one company’s product from any others. Any infringement on a trademark is illegal. For example: A globally recognized trademarked logo is Coca-Cola’s wave. Now, if any other company tries woo consumers by using...

Questions in Mind 1) What does contract management services include and how will this help my business? · Drafting and structuring tailor made contracts / agreements. Detailed and in-depth analysis of specific business and subsequent requirements. · &nb...

In Progress

Questions in Mind 1) We are a private limited Company and right now we are just in the expansion stage and there are no revenues in the Company, do we need to accomplish any compliance for the Company? Well, this is a common query which fundamentally turns up in the mind of all the start-ups. Most of the private limited Companies give a m...

Questions in Mind 1) Which type of businesses can avail these services? Any business registered in any other country outside India can avail these services. These packages would be specifically designed as per requirements of your business. 2) Are these services available to Indian businesses as well? No. These packages ar...

The Goods and Service Tax (GST) has been a biggest game changing reform in India's Indirect Tax Structure which has rightly attracted the heightened interest from all the stakeholders. From July 1, 2017 onwards, GST will replace India’s current complex Central and State indirect tax structure to create a common market with a seamless indirect tax r...

Questions in Mind 1) What are the opportunities that a start-up can get in India? · India in today’s time, is one of the fastest growing economy in the world. Major developed countries are finding immense potential in the Indian market and are keen to increase or commence their ti...

1 - 11 of ( 11 ) records