Startup Advisory

Questions in Mind

1) What are the

opportunities that a start-up can get in India?

·

India in today’s time, is

one of the fastest growing economy in the world. Major developed countries are

finding immense potential in the Indian market and are keen to increase or

commence their ties with India.

·

India has also improved

massively in ease of doing business and is ranked in 77th position from its

earlier standing at 142nd position.

·

FDI inflows ranged to $42

billion in 2018 with major investments in manufacturing, communication,

financial services and cross-border merger and acquisition activities,

highlighting India as one of the most attractive market for leading foreign

investors.

·

Also fintech has found well

backing by various start-ups, financial institutions, government, and venture

capitalists to help channelize robust investments from various stakeholders.

·

India benefits from its

efficient technical and management institutions that are of the highest

international standards that creates able human resources.

2) How can an Indian

company (private limited) be incorporated?

Ministry of corporate

affairs have done away with tortuous practice for registering a company and

hence have introduced a simplified way to form company. Now, Company can be

incorporated, together with name approval and DIN (Director Identification

Number), with the recognition of registered office of the company, PAN and TAN

and the MOA and AOA of the company with a linked form- SPICe 32, 33, 34. Now

the ministry even facilitates GST registration with the introduction of AGILE.

3) Is there any Government

Fees that I shall incur to form a company in India?

The ministry has

facilitated with zero fees up to Rs. 10 lakhs for most classes of companies.

However, there shall levy state wise stamp duty.

4) What are the structural

requirements to form a company in India?

To incorporate a company, a

minimum of 2 directors and 2 shareholders are required. Both directors and

shareholders can be same persons or different.

There exists no minimum capital

requirement for a private company.

5) What are the documents

that are required to form a private limited company in India?

·

PAN Card copies as Proof of

Nationality

·

Voter ID/Passport/Driving

License as proof of Identity

·

Copy of latest electricity bill/telephone

bill/mobile bill/bank statement as proof of residency(latest by 2 months)

·

Copy of ownership deed/sale

deed(if property is owned)

·

Copy of rent agreement

along with latest rent receipt (if property is rented)

·

Copy of latest electric

bill/telephone bill/mobile bill/gas bill in the name of the owner of the

property for the registered office proof.

·

Copy of Property Tax

Receipt.

·

Form DIR-2 by the proposed

directors

·

A declaration in the form

INC-9 by the directors and the subscribers

6) I am not an Indian

citizen. Can I form a company in India?

The Companies Act 2013

permits a foreign director or directors or be the shareholder(s) in a company.

However, there shall be present at all the times a director who is an Indian

citizen as well as resident in India. The documents as mentioned above (i.e ID

proof, residency proof) shall have to be apostilled or notarised from the

public notary or the embassy.

7) Being an Indian, I am

looking to expand in other countries. What shall be a lucrative place to start?

Reason to Expand in

Singapore

Singapore offers

advantageous loans for foreign investors, the tax incentives and exemptions,

the pro-business legislation and the State’s financial stability makes it

attractive to foreign investors. Singapore enjoys second position in ease of

doing business and fifth position in the rankings of countries receiving FDI.

It does not have tortuous compliances, has favourable tax system, has DTAA with

many countries. It has infrastructure, the banking system, and communication facilities

that are less time and money consuming which also eases in setting up a company

in Singapore. Singapore is technologically advanced facilitating innovative

solutions for various industries. It is also stands among those few countries

which facilitates and provides for well-developed fintech activities.

Reason to Expand in

Australia

Australia is an excellent

place to invest because of its population growth, highly skilled workforce,

strategic location, strong record of economic growth and a stable governance

and regulatory environment. Australia stands in 8th position as the recipient

of FDI and 18th as ease of doing business. Australia has varied economy

contributing to its growth, the sectors being Mining, energy, Tourism,

Financial Services etc Taxation in Australia is simplified and the foreign

investors need to pay taxes on their Australian earnings in line with

Australian owned companies

Reason to Expand in UK

UK has conditions that are

profoundly favourable for FDI. Setting up a business is rapid in comparison to

other European countries. London is the world leader in the financial services

sector indicating healthy and efficient banking systems. UK also has many

bilateral investment treaties with many countries factoring huge FDI

Reason to Expand in UAE

One of the factors

evidencing FDI in UAE is its strategic location, which makes it favourable to

have access to both the east and the west economies. UAE has well developed

infrastructure facilities. It is ranked as 11th in position in ease of doing

business Low Tax Rate

8) I have an online Fintech

Company catering to the needs of global customers. Which place do you recommend

for ease of forming and functioning for a Fintech Company?

Our research suggests

Fintech companies suffer most from complex regulations and compliance.

Countries like Malta, Lithuania, Labuan provides perfect environment for

operating a Fintech Company. In all of these, Financial Regulation is liberal

and it is easy to run a company.

9) Do we have to travel to

the country to run the business?

This depends on which

country you would like to open your start-up. In various countries we do not

require travelling to start any business. The entire process in based on

online.

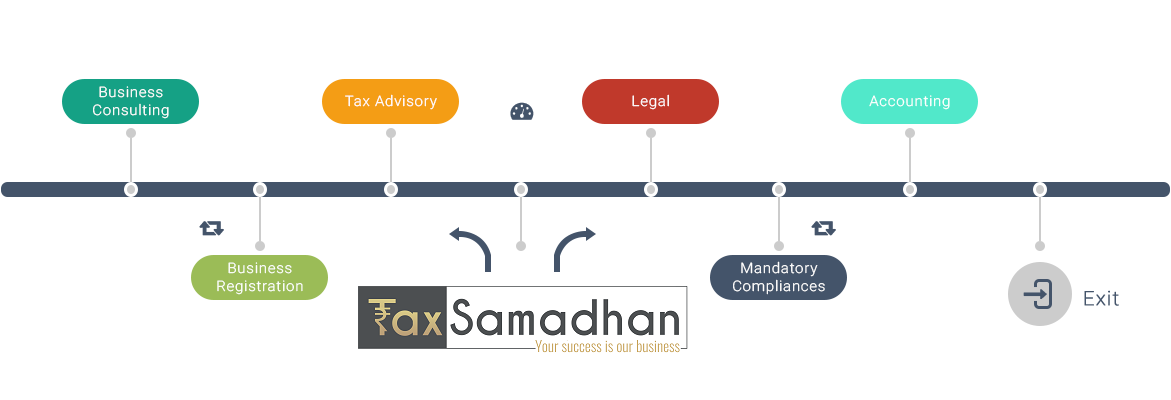

10) What are the Services

that TAX SAMADHAN provides in Global setting up?

We believe in providing end

to end solution for all your Financial and compliance need so that you do not

face any hassles in doing business. Our Service includes-

·

Setting Up

·

Nominee Directorship

·

Registered Office

·

Accounting &

International Taxes

·

Payroll and Secretarial

Services

·

Global Fundraising and

Legal Drafting

·

Work Permit and Visas