Central Government has nominated Shri Tarun Bajaj, Secretary, Department of Economic Affairs, Ministry of Finance, Government of India as a Director on the Central Board of Reserve Bank of India vice Shri Atanu Chakraborty. The nomination of Shri Tarun Bajaj is effective from May 5, 2020 and until further orders.

Questions in Mind 1) What are the opportunities that a start-up can get in India? · India in today’s time, is one of the fastest growing economy in the world. Major developed countries are finding immense potential in the Indian market and are keen to increase or commence their ti...

The Goods and Service Tax (GST) has been a biggest game changing reform in India's Indirect Tax Structure which has rightly attracted the heightened interest from all the stakeholders. From July 1, 2017 onwards, GST will replace India’s current complex Central and State indirect tax structure to create a common market with a seamless indirect tax r...

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed at ante. Mauris eleifend, quam a vulputate dictum, massa quam dapibus leo, eget vulputate orci purus ut lorem. In fringilla mi in ligula. Pellentesque aliquam quam vel dolor. Nunc adipiscing. Sed quam odio, tempus ac, aliquam molestie, varius ac, tellus. Vestibulum ut nulla aliquam risus...

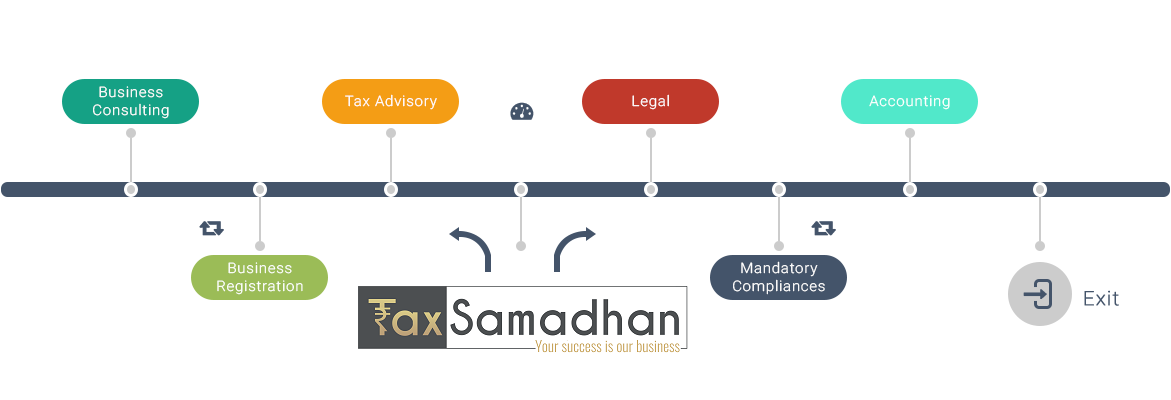

At TaxSamadhan, we have the expertise and proficiency to help you navigate through India’s dynamic and evolving regulatory environment. Several crucial reforms, policy measures and landmark legislations have been introduced in the recent years such as Benami Transactions (Prohibition) Amendment Act, Black Money (Undisclosed Foreign Income and...

Exclusive mandatory compliance offer for startups Our survey has confirmed that: Every 2nd Startup get Income Tax Notice for tax demands or for non-compliance, 3 out of 7 Startups finds place on the defaulter list of Registrar of Companies due to non-compliance, 2 out of 4 Startups incur unnecessary pay-out by way of interests and penalti...

Due Date Compliances Under various Act Under Income Tax Act Due Date Nature of Compliance in Detail 07-Jan-2020 · Deposit of TDS Deducted/Collected for the month of December, 2019. · ...

We are prominent Finance Professionals in India. We offer services in India, like accounts outsourcing, auditing, company formation in India, Business taxation, corporate compliance, starting business in India, registration of foreign companies, transfer pricing, tax due diligence, taxation of expatriates etc. HOW WE ARE DIFFERENT!...

The Reserve Bank of India (RBI) has, vide Speaking Order No DOR.CO.AID/LC02/12.22.035/2019-20 dated April 28, 2020 cancelled the licence of The CKP Cooperative Bank Ltd., Mumbai, to carry on banking business, with effect from the close of business on April 30, 2020. The Registrar of Co-operative Societies, Pune, Maharashtra, has also been reque...

The Goods and Service Tax (GST) has been a biggest game changing reform in India's Indirect Tax Structure which has rightly attracted the heightened interest from all the stakeholders. From July 1, 2017 onwards, GST will replace India’s current complex Central and State indirect tax structure to create a common market with a seamless indirect tax r...

Finding the financial transactions from the source While taking out final information from the recorded I transactions is accounting. Here I have explained the difference on the basis of Objective Time

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed at ante. Mauris eleifend, quam a vulputate dictum, massa quam dapibus leo, eget vulputate orci purus ut lorem. In fringilla mi in ligula. Pellentesque aliquam quam vel dolor. Nunc adipiscing. Sed quam odio, tempus ac, aliquam molestie, varius ac, tellus. Vestibulum ut nulla aliquam risus...

Our experienced Private Client Services team provides advisory, tax compliance and business tax planning services to high net worth individuals, their family offices, investment funds and individuals involved in commercial transactions. With the businesses going global, people and capital are crossing borders more often than ever before, which...

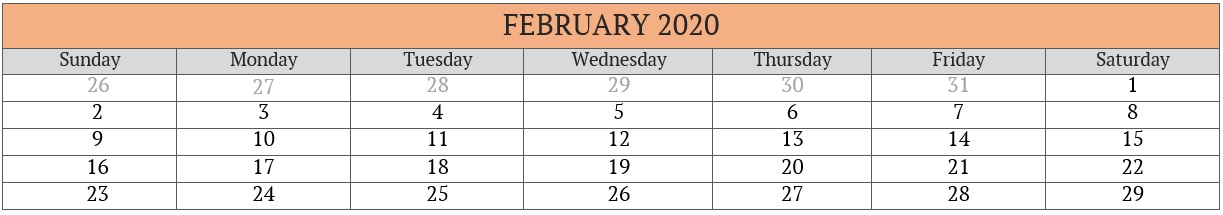

Due Date Compliances Under various Act Under Income Tax Act Due Date Nature of Compliance in Detail 07-Feb-2020 · Deposit of TDS Deducted/Collected for the month of January, 2020. · ...

Client Centric ApproachClient is the key driver of our service offerings. Our approach to service offerings is based on a client centric and customised approach. Our specialised teams are a mix of technical and industry experience in order to serve clientele for their specific needs. Quick TurnaroundWe always endeavour for a qu...

1 - 20 of ( 97 ) records