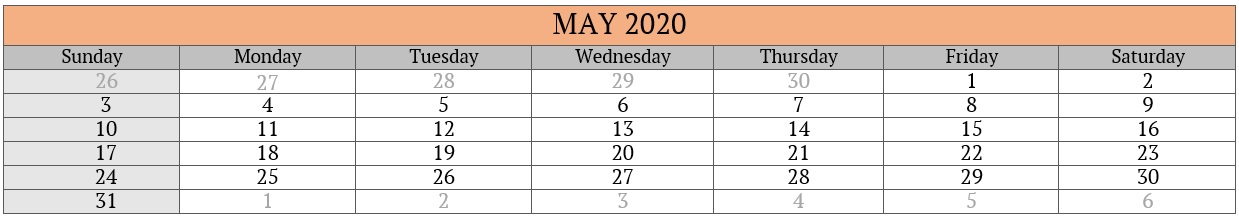

GST Filing Dates extended for providing relief to taxpayers in view of COVID-19 pandemic 1) Normal Taxpayers filing Form GSTR-3B & Interest calculation a. Taxpayers having aggregate turnover > Rs. 5 Cr. in preceding FY GSTR- 3B Return filing Date Tax period Late fees waive...

In Progress

Rates of Income Tax for the F.Y 2019-20 or A.Y 2020-21 Tax Rates for Individuals Particulars Individual & HUF (Age Less than 60 Years) Senior Citizen (Age 60 Years & Above) Super Senior Citizen (Age 80 Years & Above) Upto 2,50,0...

Due Date Compliances Under various Act Under Income Tax Act Actual Date Extended Date Nature of Compliance Compliance Period Nature of Compliance in Detail Important Notes 07-May-2020 NA TDS/TCS Liabili...

We are customers since 2013. We are very pleased with the professionalism of the whole team at Tax Samadhan. Their response is very timely and they don't leave any loose ends. Mayank is very knowledgeable and ethical. We feel we are in good hands.

Questions in Mind 1) What does contract management services include and how will this help my business? · Drafting and structuring tailor made contracts / agreements. Detailed and in-depth analysis of specific business and subsequent requirements. · &nb...

1. Income tax: · Extend last date for income tax returns for (FY 18-19) from 31st March, 2020 to 30th June, 2020.· Aadhaar-PAN linking date to be extended from 31st March, 2020 to 30th June, 2020.· Vivad se Vis...

Due Date Compliances Under various Act Under Income Tax Act Due Date Nature of Compliance in Detail 07-Jun-2020 · Deposit of TDS Deducted/Collected for the month of May, 2020. · Dep...

Switching to Tax Samadhan is one of the best business decisions we have made. If you are fed up with just being a ‘number’, look no further. Tax Samadhan and their fantastic team will make you feel valued and more importantly, will add value to your business by offering timely support and advice.

Questions in Mind1) What is a Trademark? Trademark is a symbol, word, phrase, logo, or combination of these that legally distinguishes one company’s product from any others. Any infringement on a trademark is illegal. For example: A globally recognized trademarked logo is Coca-Cola’s wave. Now, if any other company tries woo consumers by using...

It is a common practice followed by many companies, particularly by private limited companies, to register the motor cars purchased by them under the Motor Vehicles Act in the name of their directors and treat the same as its own asset in the books of account. Since the company finances the purchase of these motor cars and uses it for the purp...

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Jul-2020 · Deposit of TDS Deducted/Collected for the month of June, 2020. · Deposit of equalization levy deducted for the m...

Extensive experience in providing assurance services under various statutes across various industries for the past several decades. IND-AS, IFRS & US GAAP ADVISORY · Advising and assisting clients in respect of accounting under various GAAPs which involves assistance in implementati...

The Government of India has enacted the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 in terms of which the definition of micro, small and medium enterprises is as under: Existing MSME Classification · For Enterprises engaged in the manufacture or production, process...

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Aug-2020 · Deposit of TDS Deducted/Collected for the month of July, 2020. · Deposit of equalization levy deducted for the m...

Questions in Mind 1) How can TAXSAMADHAN help me in securing Funding? The key to a successful funding is a successful business pitch supported by a business valuation and a strong internal control system to pass the Due Diligence Check of the Investors. TAXSAMADHAN has been assisting start-ups and SMEs in securing funding for their busine...

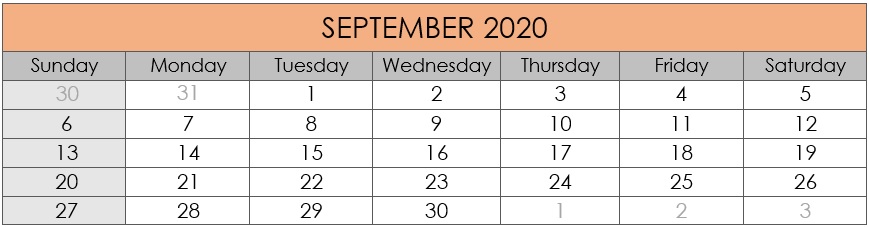

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Sep-2020 · Deposit of TDS Deducted/Collected for the month of August, 2020. · Deposit of equalization levy deduct...

Payroll process is not only the calculation of employee's basic remuneration but also any overtime payments, special payments or bonuses given to the employee in the period in question. Moreover remuneration is calculated keeping in mind hourly employees, salaried employees, new hires and terminations. Calculation of gross salaries and deductible a...

Presentation made by Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman under Aatmanirbhar Bharat Abhiyaan to support Indian economy in fight against COVID-19 dated on 13.05.2020 for Business including MSMEs- Part-1 Pradhan Mantri Garib Kalyan Package Rs. 1.70 Lakh Crore relief package under Pradhan Mantri...

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Oct-2020 · Deposit of TDS/TCS Deducted/Collected for the month of September, 2020. · Deposit of equalization levy...

41 - 60 of ( 97 ) records