Presentation made by Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman under Aatmanirbhar Bharat Abhiyaan to support Indian economy in fight against COVID-19 dated on 14.05.2020 for Poor, including migrants and farmers - Part-2 Direct Support to Farmers & Rural Economy provided post COVID...

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Nov-2020 · Deposit of TDS/TCS Deducted/Collected for the month of October, 2020. · Deposit of equalization...

Presentation made by Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman under Aatmanirbhar Bharat Abhiyaan to support Indian economy in fight against COVID-19 dated on 15.05.2020 for Agriculture - Part-3 Agriculture: Additional Steps during COVID · &nb...

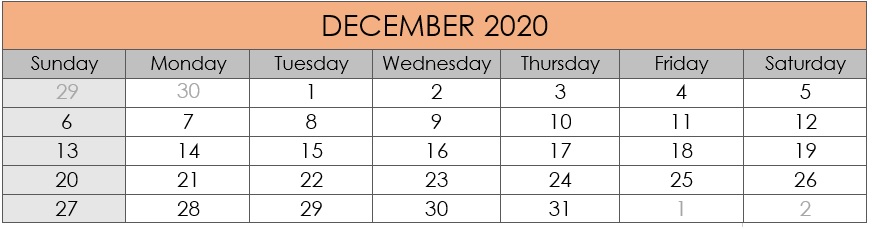

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Dec-2020 · Deposit of TDS/TCS Deducted/Collected for the month of November, 2020. · Deposit of equalization levy...

Presentation made by Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman under Aatmanirbhar Bharat Abhiyaan to support Indian economy in fight against COVID-19 dated on 16.05.2020 for New Horizons of Growth - Part-4 Policy Reforms to fast-track Investment – Effort towards Atmanirbhar Bharat...

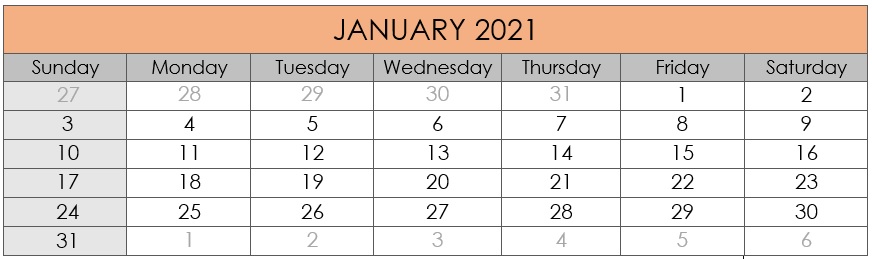

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Jan-2021 · Deposit of TDS/TCS Deducted/Collected for the month of December, 2020. · Deposit of equalization levy ded...

Presentation made by Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman under Aatmanirbhar Bharat Abhiyaan to support Indian economy in fight against COVID-19 dated on 17.05.2020 for Government Reforms and Enablers - Part-5 Health Related Steps taken so far for COVID conta...

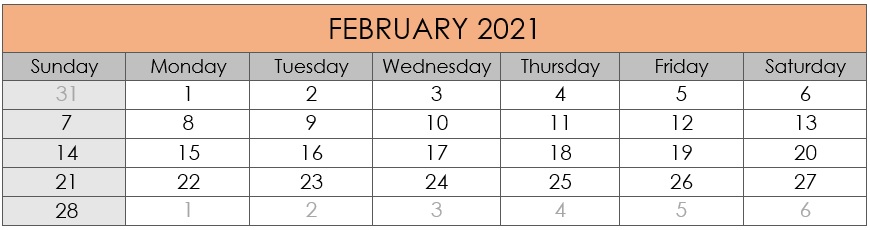

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Feb-2021 · Deposit of TDS/TCS Deducted/Collected for the month of January, 2021. · Deposit of equalization levy...

Benefits of MSME Registration In IndiaThe Indian government has always been in favor of providing benefits to Micro, small and medium enterprises (MSMEs). There are many advantages of obtaining MSME registration in India, which can be only availed if the business had registered itself as an MSME/SSI under MSME Act. The following are a few advan...

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Mar-2021 · Deposit of TDS/TCS Deducted/Collected for the month of February 2021. · Deposit of equalization...

TDS Rate Chart for F.Y. 2020-21 (A.Y: 2021-22) Section Nature of payment Threshold Limit Applicable from 1st April to 13th May 2020 Applicable from 14th May to 31st March 2021 Resident Resident Rs. TD...

Under Income Tax Act Due Date Nature of Compliance in Detail 30-Apr-2021 · 15G and 15H declaration to bank. · Due date of Payment under Vivad se Vishwas Scheme - Settling tax disputes between indiv...

(Republished with Amendments) 1) Taxpayers filing Form GSTR-3B & Interest calculation a. Taxpayers having aggregate turnover more than Rs. 5 Cr. in preceding FY GSTR- 3B Return filing Date Tax period Late fees waived if return filed on or before Feb, 202...

Under Income Tax Act Due Date Nature of Compliance in Detail 07-May-2021 · Deposit of TDS/TCS Deducted/Collected for the month of April 2021. 15-May-2021 · Qu...

Question: As a business needing to file GST returns quarterly, I have opted for IFF (Invoice Furnishing Facility). How do I generate GSTR-1 that is compatible for IFF upload? Answer: What to do in first 2 months of the quarter? After the end of the first and second months, upload B2B and CDNR tables under the IFF op...

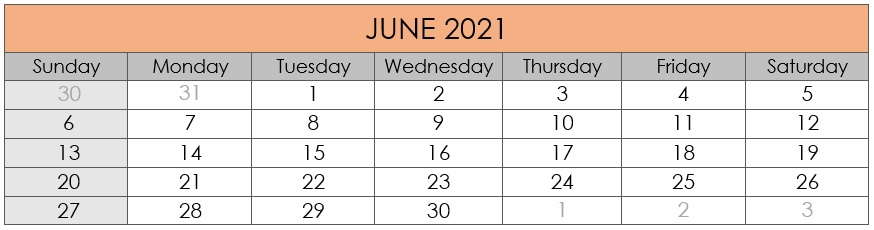

Under Income Tax Act Due Date Nature of Compliance in Detail 07-June-2021 · Deposit of TDS/TCS Deducted/Collected for the month of May 2021. 14-June-2021 · &n...

Notification No. 94/2020 dtd 22nd Dec. 2020 Applicability date: 1st January, 2021 Purpose of Rule: To avoid fake invoicing and eventually curb tax evasion. Applicability: Registered persons having taxable supply (other than exempt supply and zero-rated supply) in a month more than Rs 50 Lakh i.e.annual turnover of more than Rs 6 crore...

Under Income Tax Act Due Date Nature of Compliance in Detail 07-July-2021 · Deposit of TDS/TCS Deducted/Collected for the month of June 2021. · Deposit of TDS/TCS Deducted/Collected for the perio...

The tax on income levied by the state government on individuals is called Professional tax. Whether you are a professional, employee or trader, all are required to pay professional tax as per the specified threshold by the state government. In India, not all states levy professional tax and the tax slab or limits also varies with each state....

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Aug-2021 · Deposit of TDS/TCS Deducted/Collected for the month of July 2021. 15-Aug-2021 · Iss...

61 - 80 of ( 97 ) records