· Registered person with aggregate turnover upto INR 5 Crores during preceding year- Need to mention HSN Code of minimum 4 digits.· Registered person with aggregate turnover of more than INR 5 Crores during preceding year- Need to mention HSN Code of minimum 6 d...

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Sept-2021 · Deposit of TDS/TCS Deducted/Collected for the month of August 2021. 14-Sept-2021 · ...

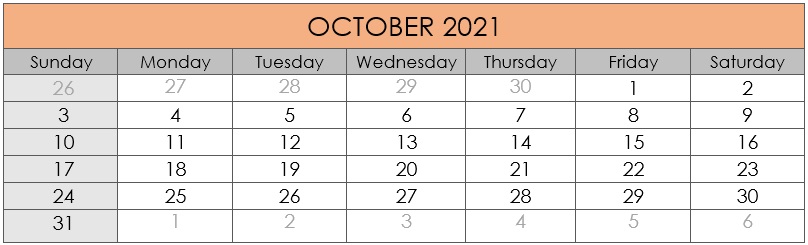

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Oct-2021 · Deposit of TDS/TCS Deducted/Collected for the month of September 2021. · Deposit of TDS for Jul...

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Nov-2021 · Deposit of TDS/TCS Deducted/Collected for the month of October 2021. 14-Nov-2021 · ...

1) Any person, being a buyer who is responsible for paying any sum to any resident (hereafter in this section referred to as the seller) for purchase of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, shall, at the time of credit of such sum to the account of the se...

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Dec-2021 · Deposit of TDS/TCS Deducted/Collected for the month of November 2021. 15-Dec-2021 · ...

Section 206 C (1H) Every person, being a seller, who receives any amount as consideration for sale of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, other than the goods being exported out of India or goods covered in sub-section (1) or sub-section (1F) or sub-section (1G) shall, at the time...

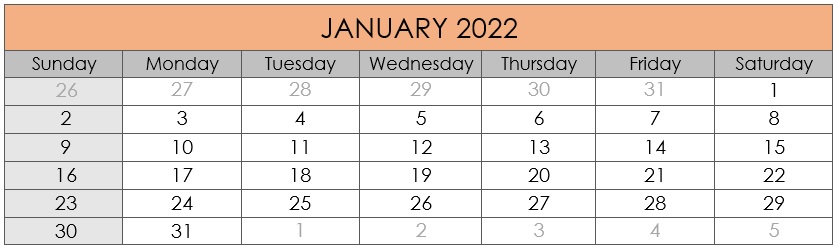

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Jan-2022 · Deposit of TDS/TCS Deducted/Collected for the month of December 2021. · Due date for deposit of TD...

Applicability of Section 206AA and 206CCA Date of Applicability- This provision will be applicable with effect from 1st July 2021. The new 206AB and Section 206CCA has been inserted after Section 206AA and Section 206CC respectively of the Act which provides for the higher rate of TDS/TCS for non-furnishing of PAN (P...

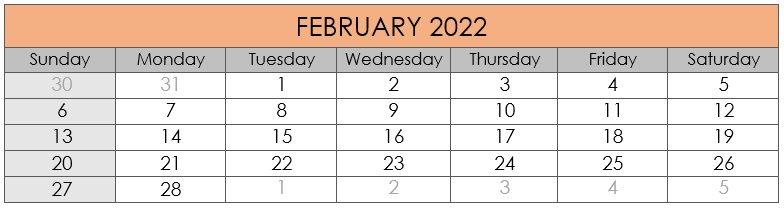

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Feb-2022 · Deposit of TDS/TCS Deducted/Collected for the month of January 2022. 14-Feb-2022 · ...

· Income tax user id & password.· Form 16 Part A & Part B.· All bank Statement/Passbook for the period of 01/04/2022 to 31/03/2023 for interest on a savings account.· In...

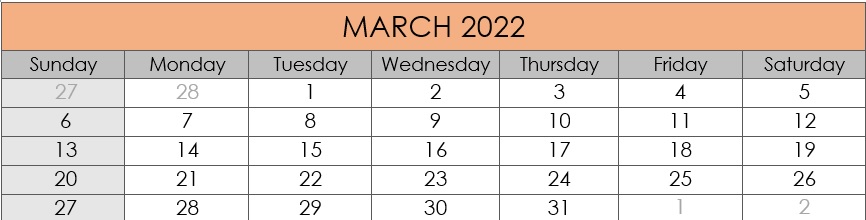

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Mar-2022 · Deposit of TDS/TCS Deducted/Collected for the month of February 2022. 15-Mar-2022 · ...

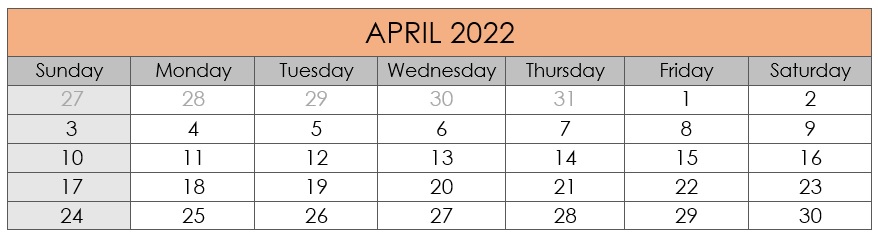

Under Income Tax Act Due Date Nature of Compliance in Detail 07-Apr-2022 · Deposit of TCS Collected for the month of March 2022. 30-Apr-2022 · Depos...

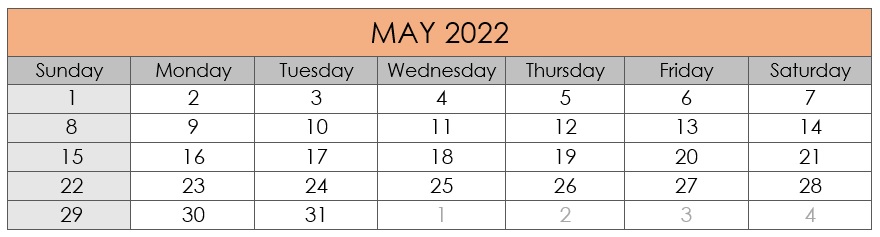

Under Income Tax Act Due Date Nature of Compliance in Detail 07-May-2022 · Deposit of TDS/TCS Deducted/Collected for the month of April 2022. 15-May-2022 · &n...

Under Income Tax Act Due Date Nature of Compliance in Detail 07-June-2022 · Deposit of TDS/TCS Deducted/Collected for the month of May 2022. 14-June-2022 · &n...

81 - 97 of ( 97 ) records