India’s budget proposal to abolish dividend tax for companies could encourage more payouts to investors, according to CLSA. The plan lets domestic companies avoid taxes on dividends received from other firms if they distribute an equal or greater amount of the payout to investors. Companies with a high share of dividend income from subsidiarie...

Questions in Mind 1) Which type of businesses can avail these services? Any business registered in any other country outside India can avail these services. These packages would be specifically designed as per requirements of your business. 2) Are these services available to Indian businesses as well? No. These packages ar...

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed at ante. Mauris eleifend, quam a vulputate dictum, massa quam dapibus leo, eget vulputate orci purus ut lorem. In fringilla mi in ligula. Pellentesque aliquam quam vel dolor. Nunc adipiscing. Sed quam odio, tempus ac, aliquam molestie, varius ac, tellus. Vestibulum ut nulla aliquam risus...

I am very happy with Tax Samadhan. Tax Samadhan provide very specialized service for all tax needs for incorporation, accounting and taxes. I have referred several colleagues and they are all very happy with the service and expertise.

We provide Risk Advisory services to assist clients enhance their risk management and stakeholder conformance while providing the foundation to achieve greater business performance. Our Risk Management team helps in better identifying, measuring and managing risk and enhancing the reliability of control systems and procedures. Our...

TAXSAMADHAN-PROVIDING HANDHOLDING SERVICES FOR We make sure that your company is closed smoothly and you are free to start a new journey. · Counselling and guiding on closure · Legal and Secretarial Services · ...

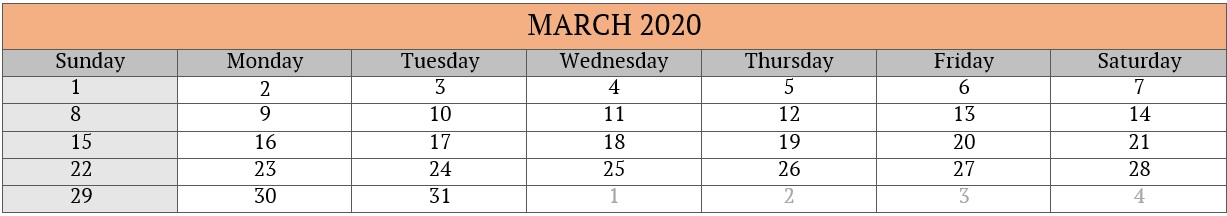

Due Date Compliances Under various Act Under Income Tax Act Due Date Nature of Compliance in Detail 02-Mar-2020 · Due date for furnishing of challan-cum-statement in respect of tax deducted under section 194-IA, 194-IB & 194M...

Over the years, we have developed systems and processes that encourage fresh graduates and Qualified Assistants to explore their full potential with guidance and support from their seniors. We support and encourage Articles to systematically learn and apply in house audit methodologies. The firm prides in maintaining a work life balance and a...

NEW DELHI : With a slew of measures to boost the Indian economy suffering from a slowdown, Finance minister Nirmala Sitharaman tabled the Union Budget 2020-21 in the Lok Sabha today. She announced the launch of a new personal income tax regime which can help the middle-class save taxes and also scrapped dividend distribution ta...

It is a long established fact that a reader will be distracted by the readable content of a page.

Questions in Mind 1) We are a private limited Company and right now we are just in the expansion stage and there are no revenues in the Company, do we need to accomplish any compliance for the Company? Well, this is a common query which fundamentally turns up in the mind of all the start-ups. Most of the private limited Companies give a m...

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed at ante. Mauris eleifend, quam a vulputate dictum, massa quam dapibus leo, eget vulputate orci purus ut lorem. In fringilla mi in ligula. Pellentesque aliquam quam vel dolor. Nunc adipiscing. Sed quam odio, tempus ac, aliquam molestie, varius ac, tellus. Vestibulum ut nulla aliquam risus...

I have been client of Tax Samadhan for the past 3years. Their service is second to none. A highly knowledgeable and skilled team who go above and beyond to meet their client’s needs. A personal approach with a can do attitude. I would strongly recommend their services and have introduced them to a number of personal and business contacts.

The firm provides comprehensive and supported solutions for the seamless transition to IFRS and assist in appropriate treatment and disclosures under IFRS. We work closely with our clients and devise and implement appropriate methodology and transition structure suited to the individual requirements of our clients. A qualified and experienced...

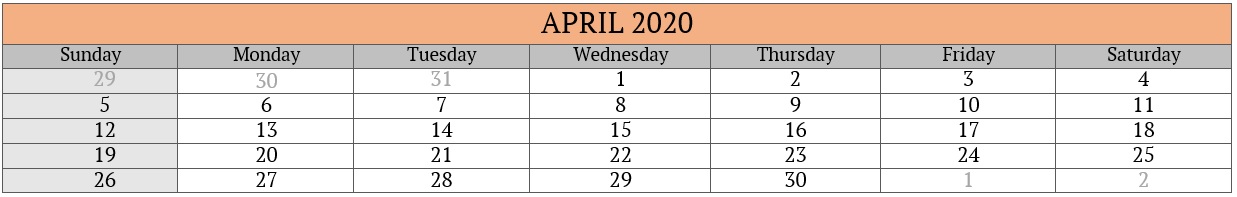

April 2020 Due Date Compliances Under various Act Under Income Tax Act Due Date Nature of Compliance in Detail 07-Apr-2020 · Deposit of TDS Deducted/Collected for the month of March, 2020. · &nb...

Tax Samadhan is a tax and legal firm involved in setting up business, cross border tax & legal compliance with fundraising assistance.We are pioneers in driving all legal and compliance services online under one single umbrella which caters to the complete lifecycle of regulatory compliances. Technology adoption at Tax Samadhan goes a long...

FAQ 1. Whether the financial year is changed to June 2020 closing? a) No, the financial year closure is not extended. Only the date of compliance which were required by 31stMarch 2020 either by the taxpayers or by the tax authorities has been deferred till...

Opposition parties on Monday accused the administration of Prime Minister Narendra Modi of presenting a directionless budget for FY21 and questioned the various fiscal projections during a debate in Parliament, highlighting the government’s limited spending power amid an economic slowdown. Senior Congress leader P. Chidambaram, wh...

21 - 40 of ( 97 ) records